Ethereum Price Prediction: Navigating Volatility Toward $10K Target

#ETH

- Technical indicators show ETH testing crucial support at $4,080 with MACD maintaining bullish momentum despite recent price pressure

- Fundamental developments including record stablecoin growth and institutional ETF demand support long-term $6K-$10K price targets

- Short-term volatility from Ethereum Foundation selling and market sentiment may create buying opportunities before potential October breakout

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

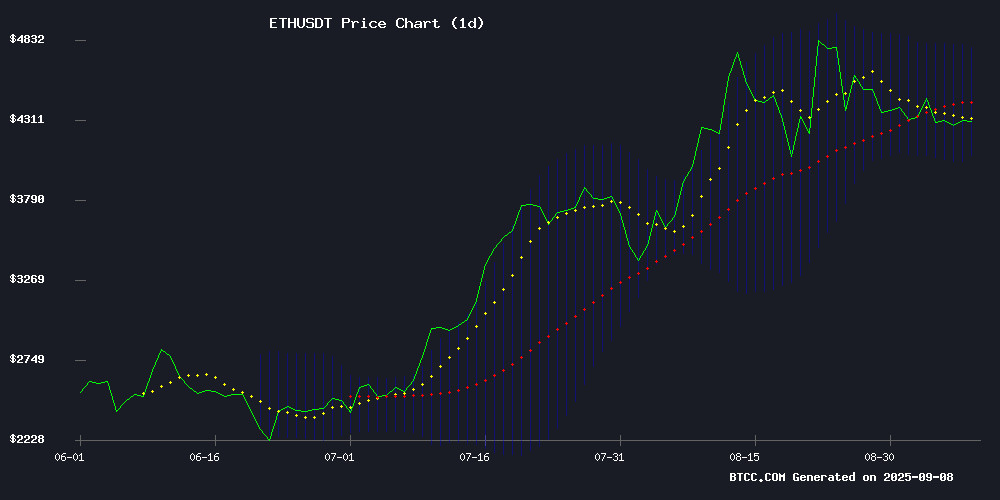

ETH is currently trading at $4,300.36, below its 20-day moving average of $4,432.43, suggesting potential short-term bearish pressure. The MACD indicator shows a positive reading of 147.74, indicating bullish momentum remains intact despite recent price declines. Bollinger Bands position the current price NEAR the lower band at $4,079.16, which could act as strong support. According to BTCC financial analyst Mia, 'The technical setup suggests ETH is testing crucial support levels. A hold above $4,080 could pave the way for a rebound toward the middle Bollinger Band around $4,432.'

Market Sentiment: Bullish Fundamentals Amid Short-Term Volatility

Recent news highlights contrasting developments for Ethereum. Positive indicators include record stablecoin market dominance with $165 billion supply, shrinking exchange reserves suggesting whale accumulation, and maintained $6K price targets from analysts. However, the ethereum Foundation's planned sale of 10K ETH and the Kinto token crash create near-term headwinds. BTCC financial analyst Mia notes, 'While institutional ETF demand could propel ETH to $10K long-term, September may see continued volatility before a potential October breakout. The fundamental narrative remains strongly bullish despite temporary setbacks.'

Factors Influencing ETH's Price

Stablecoin Market Hits Record High as Ethereum Dominates with $165 Billion Supply

Stablecoin adoption has surged to unprecedented levels in 2025, with retail transactions and total supply shattering records. Ethereum continues to lead the market, boasting a $165 billion stablecoin supply—a $5 billion weekly increase—while maintaining 57% dominance across all stablecoins and 77% in tokenized commodities.

Retail transfers under $250 reached a historic $5.8 billion in August alone, eclipsing 2024's total volume. Emerging markets drive this growth, with 70% of surveyed users in Nigeria, India, and Southeast Asia adopting stablecoins to circumvent banking fees and sluggish transfers. Binance Smart Chain now captures nearly 40% of retail activity, while Tron's market share declines.

Kinto Token Crashes 91% as Ethereum L2 Project Shuts Down After Hack

Kinto Network's governance token plummeted over 91% after the team announced the shutdown of its Ethereum layer-2 blockchain by September's end. The project, built on Arbitrum and settled on Ethereum, aimed to merge centralized exchange efficiency with decentralized security but succumbed to financial and security challenges.

A July exploit drained 577 Ether ($1.6 million) from Kinto's protocol due to a vulnerability in the ERC-1967 Proxy standard. Despite raising $1 million in debt to revive its modular exchange, worsening market conditions and failed fundraising efforts forced the wind-down. The team has operated without salaries since July.

Users can withdraw assets normally, while Phoenix lenders will recover approximately 76% of their funds. Morpho victims are eligible for claims up to $1.1k each. The shutdown marks the end of an ambitious project that once offered tokenized stock trading for giants like Apple and Microsoft.

Ethereum Price Prediction: $6K Target Maintained Amid Market Volatility

Ethereum's price trajectory remains bullish despite recent spot market weakness, with analysts projecting a climb to $6,000 by 2025. The cryptocurrency has demonstrated resilience, holding support between $4,200 and $4,400 after a brief dip below $4,300. Technical indicators suggest the next critical resistance lies near $5,000.

Macroeconomic factors including global inflation and monetary policy continue to influence market sentiment. Ethereum's entrenched position in DeFi, NFTs, and enterprise adoption insulates it from the volatility plaguing smaller projects. Institutional interest grows as ETF speculation fuels confidence in ETH's long-term viability.

Emerging platforms like MAGACOIN FINANCE are gaining attention as diversification opportunities, though Ethereum maintains its dominance. Whale accumulation patterns and anticipated liquidity inflows suggest the foundation exists for sustained upward momentum.

Crypto Projects Secure $185 Million in Weekly Funding Surge

Venture capital continues flowing into blockchain ventures despite market volatility, with $185 million raised across 22 projects last week. Ethereum-focused infrastructure dominated the largest deals, signaling sustained institutional confidence in the network's scalability roadmap.

Etherealize's $40 million Series A led the pack, backed by Paradigm and Electric Capital. The firm aims to build institutional-grade marketing and product development tools for Ethereum ecosystems. Close behind, Utila secured $22 million for its enterprise custody solutions, while Kite AI landed $18 million to merge artificial intelligence with blockchain automation.

The funding distribution reveals clear sector priorities: 45% went to Ethereum L2/L3 infrastructure, 30% to AI-blockchain hybrids, and 25% to DeFi middleware. Polychain Capital and DCG emerged as the most active investors, participating in three deals each.

Ethereum Surges as Exchange Supply Shrinks: Are Whales Accumulating?

Ethereum's exchange supply dynamics are drawing attention as reserves continue to decline, signaling potential accumulation by large holders. Analyst Kyle Doops notes the contraction in ETH reserves on centralized exchanges, suggesting reduced sell-side pressure and a possible precursor to upward price movement.

The $4,150 support level remains robust amid short-term market weakness. This trend emerges against a backdrop of heightened risk aversion among altcoin investors, compounded by macroeconomic uncertainties during the early months of a new political administration.

Ethereum Price Forecast: Institutional ETF Demand Could Propel ETH to $10K

Ethereum has emerged as the centerpiece of institutional demand, with ETF interest and on-chain metrics signaling potential for a significant breakout. Analysts project a rally toward $10,000 in the next cycle as capital flows reshape the market. Despite a 15% correction from its August 24 peak, ETH maintains resilience at $4,300—a consolidation phase preceding what some believe could be a push beyond $5,000.

Network activity underscores Ethereum's dominance. A 30% weekly spike in fees dethroned Tron as the highest-grossing blockchain. Layer-2 adoption compounds this strength, though macroeconomic headwinds linger. Nasdaq's 1.3% decline and gold's record high reflect broader market unease, exacerbated by geopolitical tensions following Trump's remarks on India-China-Russia relations.

While Ethereum commands attention, altcoins like MAGACOIN FINANCE gain traction through community-driven growth. The market watches whether ETH's institutional momentum will cascade into broader altcoin rallies.

Ethereum Foundation Plans Gradual Sale of 10K ETH, Drawing Mixed Reactions

The Ethereum Foundation has announced plans to liquidate approximately 10,000 ETH through centralized exchanges, sparking debate within the crypto community. Proceeds from the sale, which will be executed in smaller batches over several weeks, are earmarked for research and development, ecosystem grants, and charitable donations.

Market participants expressed concern over potential downward pressure on ETH prices, though the foundation emphasized its commitment to minimizing disruption. Critics argue alternative funding mechanisms should be explored to avoid unnecessary sell-side pressure.

The transparency notice garnered significant attention, with the foundation's social media post surpassing 900,000 views within hours. This move highlights the delicate balance between project funding and market stability in decentralized ecosystems.

Ethereum Faces Pivotal September Selloff Before Potential October Breakout

Ethereum's price trajectory mirrors its 2021 bull run pattern, with analysts anticipating a September dip to $3,350 before a potential surge. The current consolidation phase shows striking similarities to ETH's 2021 behavior when it dropped 30% before rallying to new highs.

Institutional demand remains robust, with US spot Ethereum ETFs absorbing 286,000 ETH last week. Technical indicators suggest an inverse head-and-shoulders formation could propel ETH toward $10,000, despite its current 11.7% decline from all-time highs at $4,374.

Crypto trader Johnny Woo warns of a potential 'bear trap' scenario. 'It might look bearish at first, but if it plays out, it could be the biggest bear trap I've ever seen,' he noted, drawing parallels to September 2021's price action that preceded ETH's climb from $2,750 to $4,000+.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH shows potential for significant upside movement toward $6,000-$10,000 targets, though short-term volatility may persist through September. Key factors supporting this outlook include:

| Target Level | Probability | Timeframe | Catalysts |

|---|---|---|---|

| $6,000 | High | 6-12 months | ETF demand, institutional adoption |

| $8,000 | Medium | 12-18 months | Ecosystem growth, scaling solutions |

| $10,000 | Medium | 18-24 months | Macro adoption, regulatory clarity |

BTCC financial analyst Mia emphasizes that 'current support levels around $4,080 must hold for these targets to remain valid. The combination of technical support and strong fundamentals creates a compelling risk-reward scenario for long-term investors.'